Guide to Success in China: Haircare Brand

This is a series from our weekly newsletter in which we send out original content covering trends, social campaigns and advice on how to grow your brand in China. This series, GUIDE TO SUCCESS covers the audience, channels, and strategy for an imaginary brand entering the China market. We hope this gives you a starting point to better understand the type of information you'll need to know about your customer and how to use the right channels to reach them. Get this sent directly to your inbox instead of having to visit our website next time.

THE BRAND

International hair care brand with a product range including; shampoo, conditioner, hair mask, scalp care essence, etc.

THE TARGET AUDIENCE

Age: 18-35

Living in: Tier 1, 2 cities

ANALYSIS

Due to the pressure of study and work more young consumers in China have begun to join the "bald army”.

😬 Yikes..

According to the "2022 Anti-Hair Loss Shampoo Research Report" released by Ipsos, the number of people suffering from hair loss in China has exceeded 250 million, and the proportion of hair loss before the age of 30 is as high as 84%.

In addition to hair loss, scalp sensitivity, acne, dandruff, oily, etc. are also highly searched topics on social media. In the past, shampoo and hair care brands usually focused on the basic functions of cleaning, anti-dandruff, and smoothing, but now, hair care is the new skin care.

CHANNELS

Xiaohongshu (RED)

Due to the lack of brand awareness in the domestic market, the new rise high-end hair care brands from other countries may want to use Xiaohongshu as the main investment platform for market operation.

Xiaohongshu users mainly;

✅ live in first and second-tier cities

✅ women who pursue fashion and beauty

The new hair care concepts, such as "scalp health”, "Spa experience” and "life aesthetics”, have already formed a new consumption trend among this audience. By cooperating with active influencers, brands can effectively reach the target consumer groups and amplify exposure.

🛒 Add to cart. Xiaohongshu also supports the establishment of certified brand ecommerce stores so users can directly jump to the product page to browse and place an order by clicking on the promotion image, which greatly shortens the purchase journey.

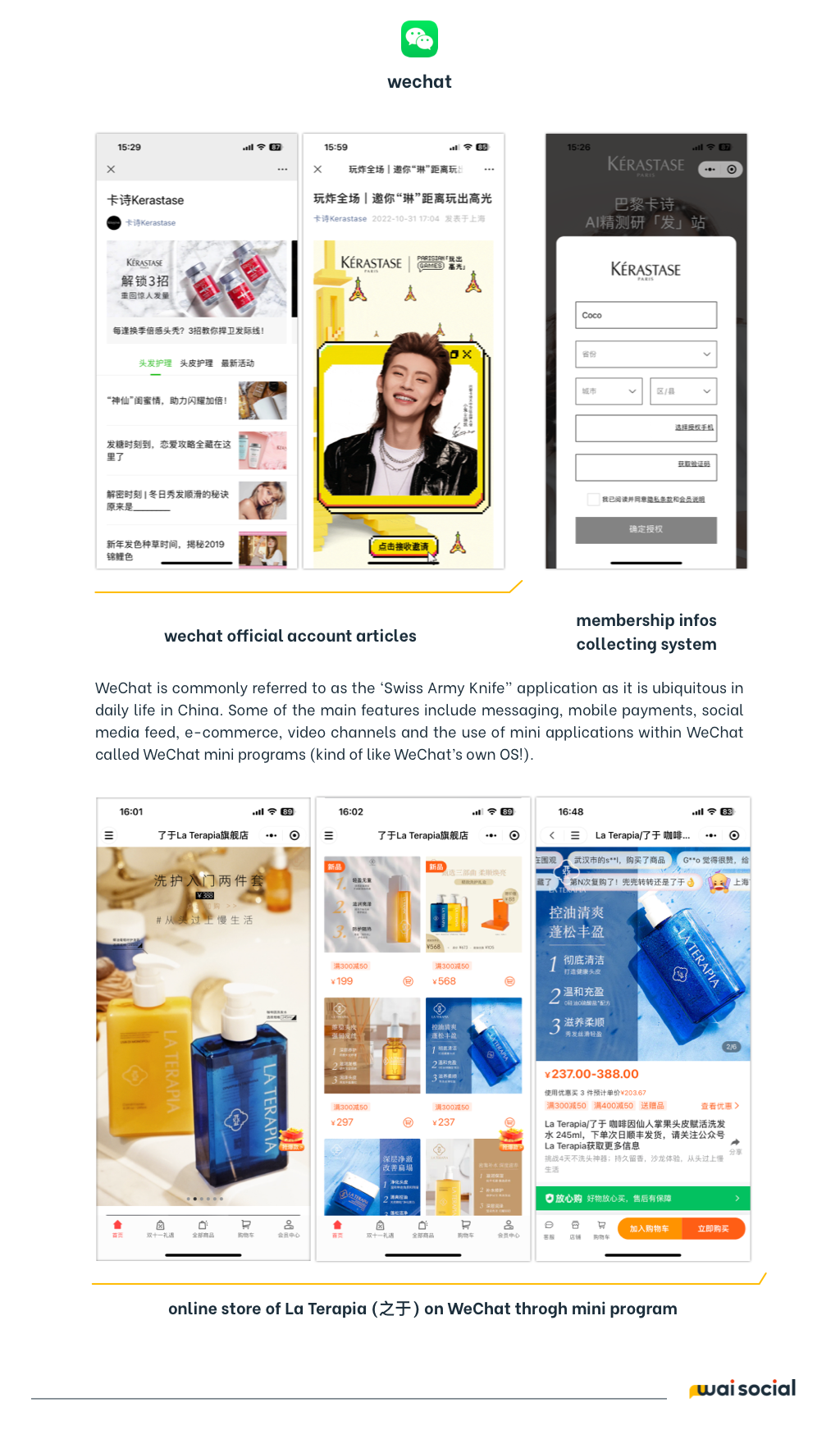

Having an official WeChat Channels account can make it easier to insert video content in WeChat articles and mini-programs. For luxury brands targeting female consumers, these beautifully produced dynamic pictures will be an important way to deliver brand messaging. Use the live-streaming feature to launch products and fashion shows for VIPs.

Compared with Xiaohongshu, WeChat is a platform with higher credibility and more comprehensive functions, which is suitable for well-known brands to further explore ways to interact with users and deepen connections.

For example, Kérastase loaded a member information collection system on its official WeChat account, continuously synced new products, and published news of collaboration events with celebrities. Although the direct linking between WeChat and Tmall is not yet used, it is still very easy for consumers to actively go to Tmall and other online shopping channels to purchase products due to the popularity of the brand itself. Or it is perfectly OK to install an online store inside WeChat through a WeChat ecommerce mini program.

Short Video - Douyin & Kuaishou

With the rise of the short video economy, many new rising hair care brands have placed their investment to video platforms such as Douyin and Kuaishou to achieve quicker brand awareness spread and sales conversion.

Although most of the active users of these platforms live in third and fourth-tier cities, with changes in the social environment (more time at home and less mobility between cities), residents of first and second-tier cities are also beginning to use Douyin to learn about life dynamics, and enter live-streams to buy products with favorable prices.

Take Roye (若也) as an example, a brand established in 2020, whose products focus on hair care, scalp care, and hair styling with scientific research patents, its sales in the Douyin daily live-stream room can reach 50% of the total sales.

INFLUENCER STRATEGY

Today, very convincing influencers and even celebrities can be found promoting hair care products on popular Chinese social media platforms such as Xiaohongshu and Douyin. Content covers various hair care methods that are beneficial to hair growth, black hair, moisturizing, and preventing hair loss are also hot topics that users are very concerned about. Focusing your budget on working with these influencers will have higher market value than working with many micro-influencers.

In addition, influencers with professional backgrounds in hair care, medicine, or aesthetics lifestyle are also worth looking at—depending on whether the brand’s positioning is focused on efficacy or a premium experience.

ECOMMERCE

Tmall and JD.Com are the main ecommerce platforms that people use for hair care products purchasing, besides that, Sam’s Club also can be considered - especially for new rising brands targeting middle-class consumers.

OTHER IMPORTANT THINGS TO KEEP IN MIND

1. Due to the control policy of social media accounts, brands opening online stores need to prepare relevant domestic trademark registration, industry qualification document, and other required paperwork before they start to apply for a verified account, so as to avoid any schedule delay.

2. Although Douyin is known as a short video platform, with the full development of ecommerce capabilities, more and more brands are allocating their investment in video content production to non-stop live-streaming promotions and influencer collaborations. Compared with the continuous output of eye-catching creative videos, live-streaming is easier for brands to operate, and the returns are more calculable.

3. Chinese users have a higher demand for hair blackening, hair loss improvement and hair moisturizing more than other issues. Currently, the market for hair care education through improved scalp health is maturing and has broad consumption potential.

4. The "lazy economy” (懒人经济) has also created a large number of new demands in the hair and scalp industry. Products such as leave-in spray, hair fluffing powder, and leave-in shampoo are being welcomed by more and more consumers, especially the younger generation who always seek time-saving and labor-saving solutions.

5. Hair care products linked to high-end chain barbershops, scalp management stores, and spas are most likely to attract the attention of target consumers. At the same time, cooperation with fashion stars and variety shows can also effectively enhance brand awareness.

6. In the middle & low-end market, the effect is king; in the high-end market, preferences in ingredients, fragrance, and experience will further segment consumer groups. Generally speaking, Chinese consumers have a strong demand for hair care, but how to stand out among many competitors and find the most accurate target group for effective communication will be the biggest challenge.