Guide to Success in China: Luxury Fashion - Shoes & Accessories

This is a series from our weekly newsletter in which we send out original content covering trends, social campaigns and advice on how to grow your brand in China. This series, GUIDE TO SUCCESS covers the audience, channels, and strategy for an imaginary brand entering the China market. We hope this gives you a starting point to better understand the type of information you'll need to know about your customer and how to use the right channels to reach them. Get this sent directly to your inbox instead of having to visit our website next time.

THE BRAND

Luxury fashion brand — shoes & accessories

THE TARGET AUDIENCE

Age 18-35

Living in: Tier 1, 2 cities

ANALYSIS

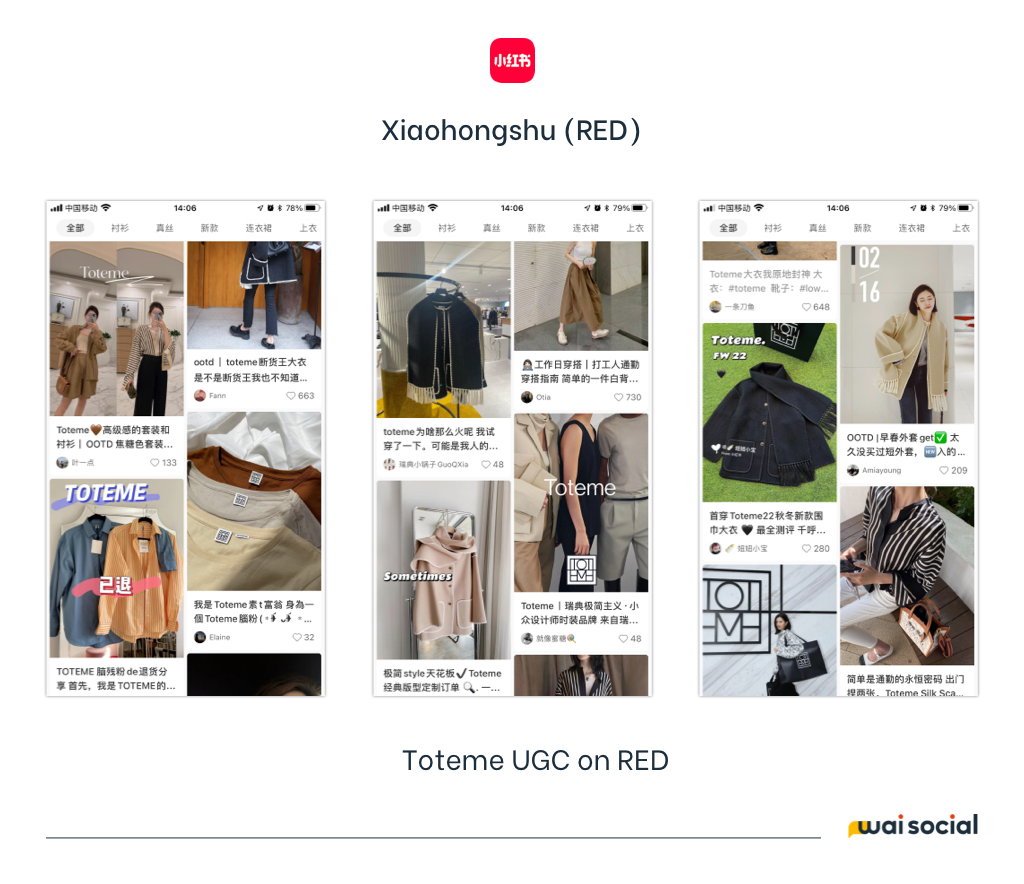

Although the majority share of China's luxury market has been captured by well-known international brands, there is still room for niche luxury brands. Just take Swedish brand Totême and French brand Lemaire as an example. When we look at Chinese consumer acceptance and love, it can be said that there are many opportunities left in this market.

After years of brand edification, China's luxury consumers have formed unique habits. They shop seasonally from well-known brands, while keenly searching for niche products that express their personal taste, especially when it comes to women's bags and shoes.

With the right balance of forward-looking brand positioning and precise marketing strategies, "popularity" may just be a matter of time.

CHANNELS

Use WeChat for;

Brand-intro & storytelling

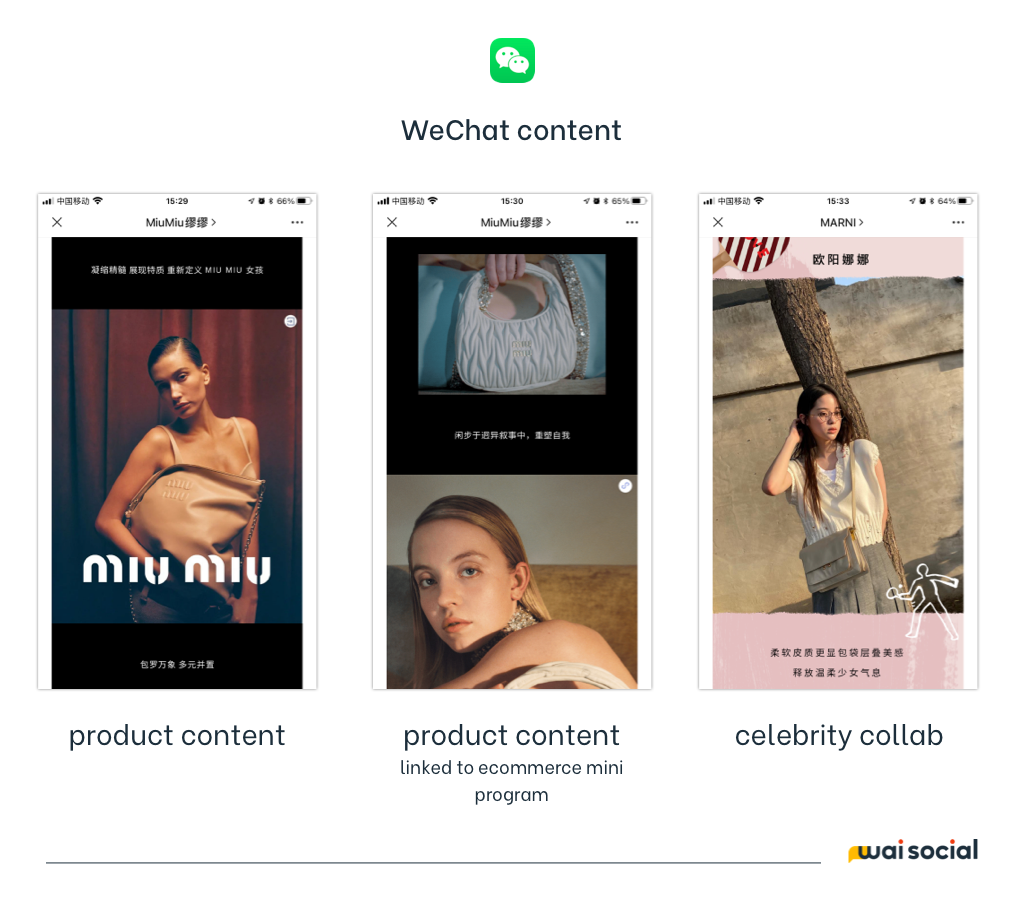

Content creation in the form of; News, Events, Product launches and collaborations

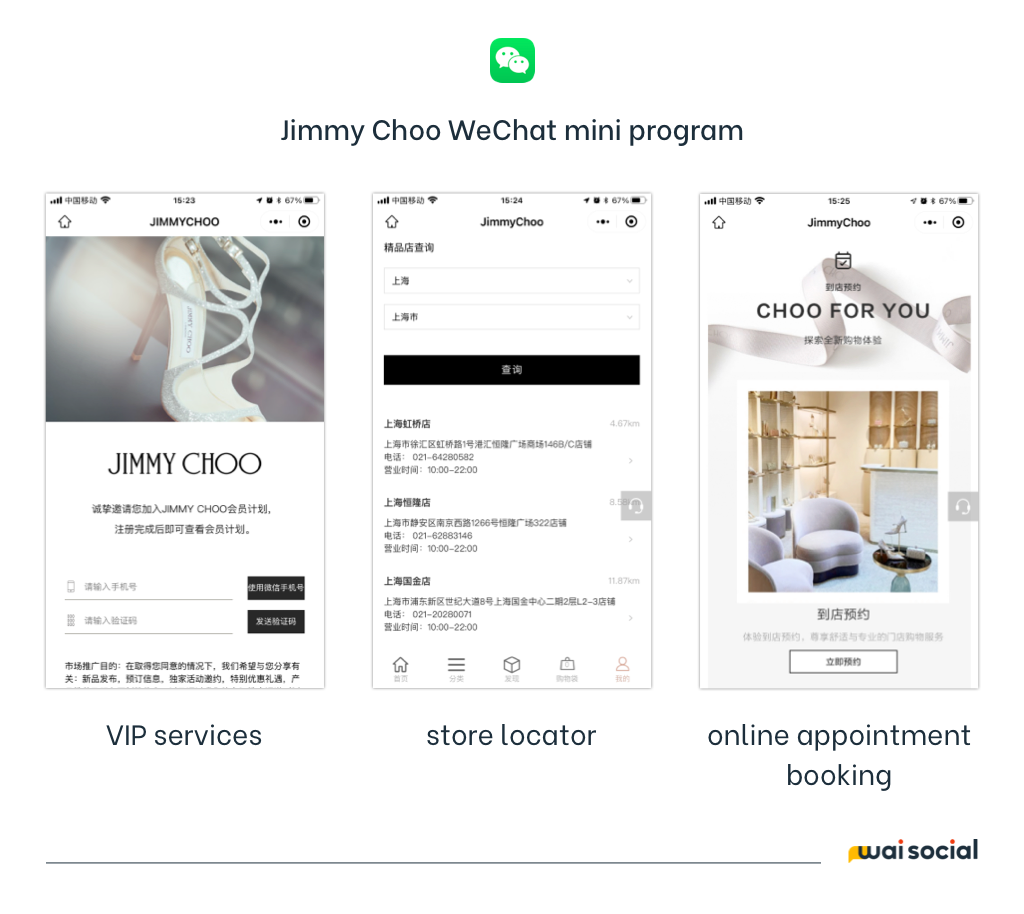

Most important; Online & offline shopping services (well designed fully functional online store via WeChat mini program. Location services to find the nearest store, scheduling functions for booking VIP appointments

Having an official WeChat Channels account can make it easier to insert video content in WeChat articles and mini-programs. For luxury brands targeting female consumers, these beautifully produced dynamic pictures will be an important way to deliver brand messaging. Use the live-streaming feature to launch products and fashion shows for VIPs.

Xiaohongshu (RED)

RED is a key channel for luxury brands targeting female consumers to expand awareness. Most potential consumers are active users and love to share and discover new products and brands.

*Due to platform limits especially on customization, it is not of high importance to open a RED ecommerce store at this time.

The “mark” (标记) on the official account page provides a specific area to display content generated by influencers and celebrities, and also helps to showcase themed campaigns.

Weibo relies on interactions between accounts to achieve influence and growth — if your strategy includes high-frequency collaborations with Chinese celebs in the future, it is worth opening an official account. But be mindful that any political or culturally sensitive missteps can easily spiral into a large-scale brand PR crisis on this platform.

*Dior plagiarism incident has been reported on 92 media Weibo accounts including China Daily, and influencers who posted related content received over 10,000 likes.

Douyin (TikTok)

Although many reports show that the trend of Douyin's rise as an e-commerce platform cannot be ignored, for luxury brands, there are still concerns on matching issues about active user groups and popular content types. Aside from ‘established’ luxury brands like LV and Burberry, which also have massive awareness and consumption potential even in second-and third-tier cities, most other brands are cautiously approaching managing an official account on Douyin.

*Golden Rule: ‘don’t be on all channels, be on the right channels

INFLUENCER STRATEGY

Investment in major celebrity and influencer collaborations on platforms such as Weibo and Xiaohongshu is key to building a strong awareness in the Chinese market.

For brands that have already formed a reputation in foreign markets, they can localize Instagram content or find cross-platform influencers to help complete a "regional transformation”. Chinese consumers are happy to discover niche products or brands that are not yet popular in China.

ECOMMERCE

As a luxury brand, it is okay not to establish store on Tmall right away, but we recommend building up an official website in Chinese to combine the brand intro, news, and online store.

Having a well-designed, fully functional mini program on WeChat as another online purchase access will be necessary. Don’t forget to cooperate with other luxury e-commerce companies, such as Net-a-Porter, and Farfetch.

OTHER IMPORTANT THINGS TO KEEP IN MIND

Digitization is increasingly becoming the driving force behind fashion tech investment in the luxury sector. In the Chinese market, creating a fully functional online store and VIP service experience in WeChat is a compulsory course for almost all luxury brands.Several online service upgrade directions that can be referred to:

AR/VR; Help users eliminate the influence of shopping space through visual scene reproduction;

1 to 1 video chat; Bring the unique one-to-one service advantages of luxury offline to online through technical means

Online pre-order; Allow customers to pre-order online the latest items on the show to help brands collect orders in a faster and digital way

NFT tokens; Due to the popularity of the Metaverse, some luxury brands have begun to try new ways of NFT digital collections, integrating technology trends into retail, which can extend more possibilities for event operations.

Exercise caution when following trends. Although some luxury brands are observed gaining popularity in the market through "ugly or incomprehensible" products, for emerging brands that have not yet established a "first impression”, it is necessary to take this step carefully.