Chinese Brand to Know: To Summer

This is a series from our weekly newsletter in which we introduce a Chinese brand you need to know. Because 1) there are some seriously cool Chinese brands out there doing some great marketing and 2) we believe it can help you better localize your own marketing in China. Get the newsletter sent directly to your inbox instead of having to visit our website next time.

BRAND NAME

To Summer 观夏

CATEGORY

Niche Perfume

Mid-to-high-end plant-based fragrance combining Eastern philosophy and culture

PRICE POINT

Perfume: USD 70-85 per bottle (30 ml)

Indoor fragrance (candles, diffuser & wax tablet): USD 28 - 96

Bath & body collection: USD 20-35

Accessories: ~ USD 20

TARGET AUDIENCE

Middle-class female consumers who often purchase international perfume brands

WHAT THEY ARE DOING WELL

1. To Summer chose to combine vivid artistic expression with the use of Chinese characters, quickly arousing an emotional resonance with its audience using minimal effort

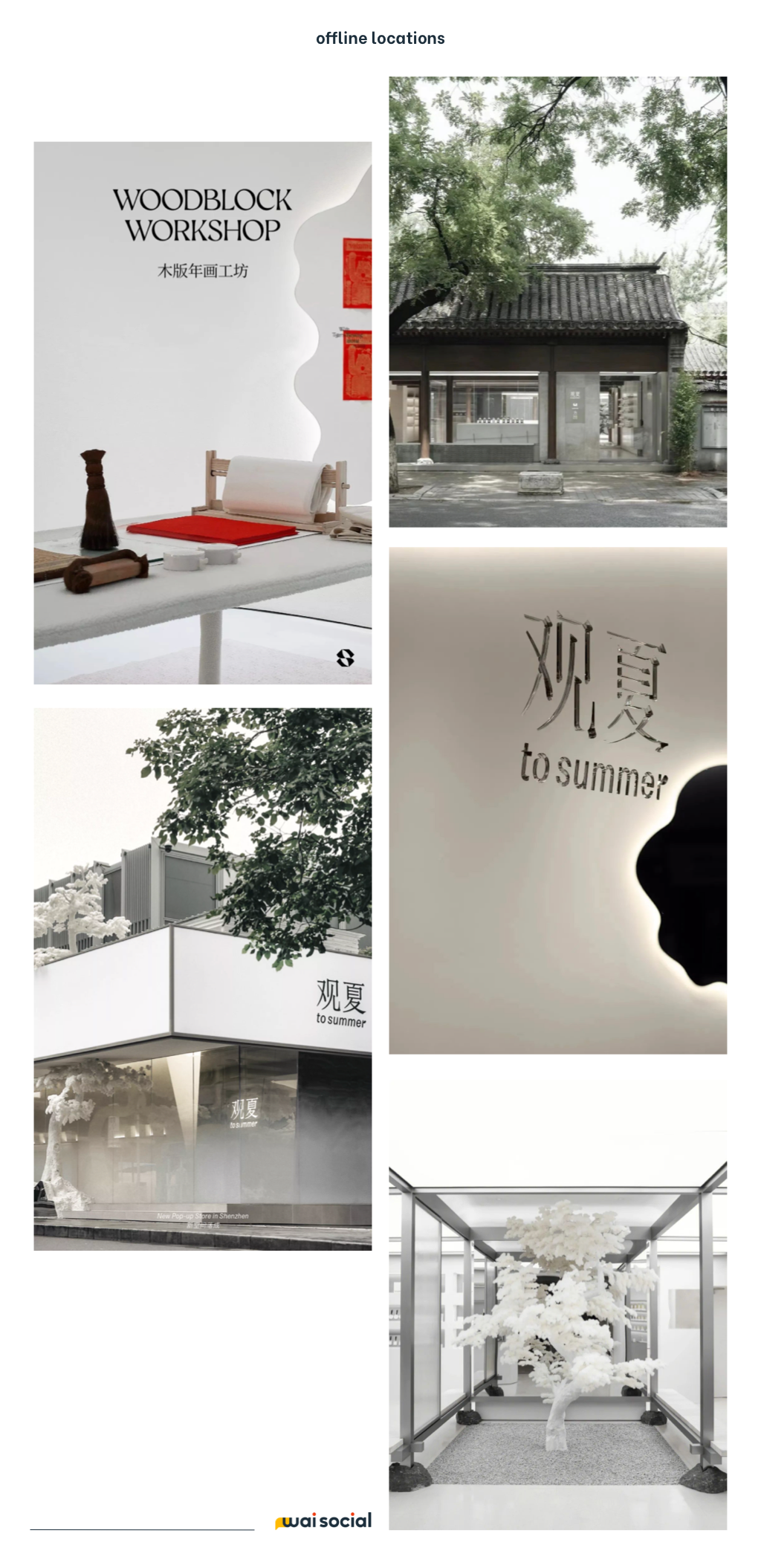

2. In addition to the exquisite language design, for the brand’s offline locations, To Summer selected historical buildings in Beijing and Shanghai that hold a particular significance among locals and foreigners

3. The ancient buildings used for the brand’s offline stores integrate metal, concrete, and other materials together with modern elements to create a uniquely “Oriental New Modern (东方新摩登) style synonymous with the brand itself. The design not only echoes the expression of products but also creates an ideal space for multiple offline activities in future

4. To Summer creates scarcity and excitement with limited-time buying as the main method

5. The brand leverages the "China-Chic” (国潮) concept — taking a risk to create something new while continuing a legacy of cultural self-confidence. It is smart and accurately grasps the current consumers' psychology and unspoken expectations

WHAT CAN OTHER BRANDS LEARN FROM TO SUMMER?

1. Perfect timing. When To Summer started, the domestic fragrance market was nearly completely dominated by foreign brands, especially in the mid-high-end category. At the same time, the market for this category was growing rapidly. To Summer grasped a great opportunity for new brands to emerge.

2. Smart price positioning. Compared with local fragrances, the price is generally much higher, but at the same time it is slightly lower than that of international brands, such as Jo Malone, Diptyque, etc. - This makes it easier for consumers to make alternative decisions.

3. Start niche. In terms of product development, To Summer began from the home fragrance category. It now mainly has aromatherapy, balm, perfume, and body care product lines, of which aromatherapy is the core. At the same time, they launch creative products with limited amounts according to traditional festivals and four seasons to keep expanding brand awareness.

4. Price point. To Summer builds up their online and offline stores not simply based on cost-effectiveness, but taking them as an experience place that truly restores the tonality of oriental aesthetics, allowing everyone to experience products and cultural values, thus generating a deep emotional connection to the brand.

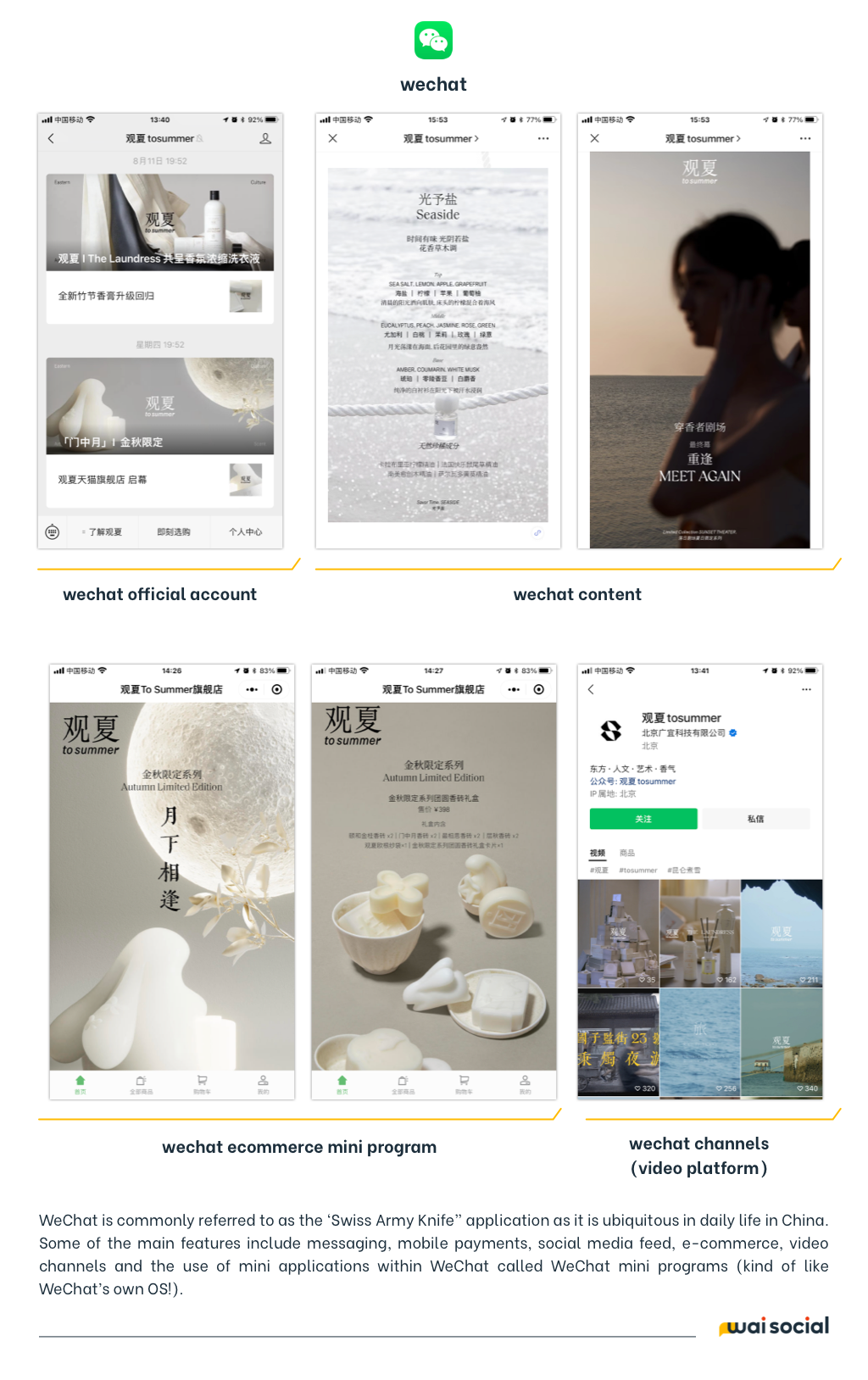

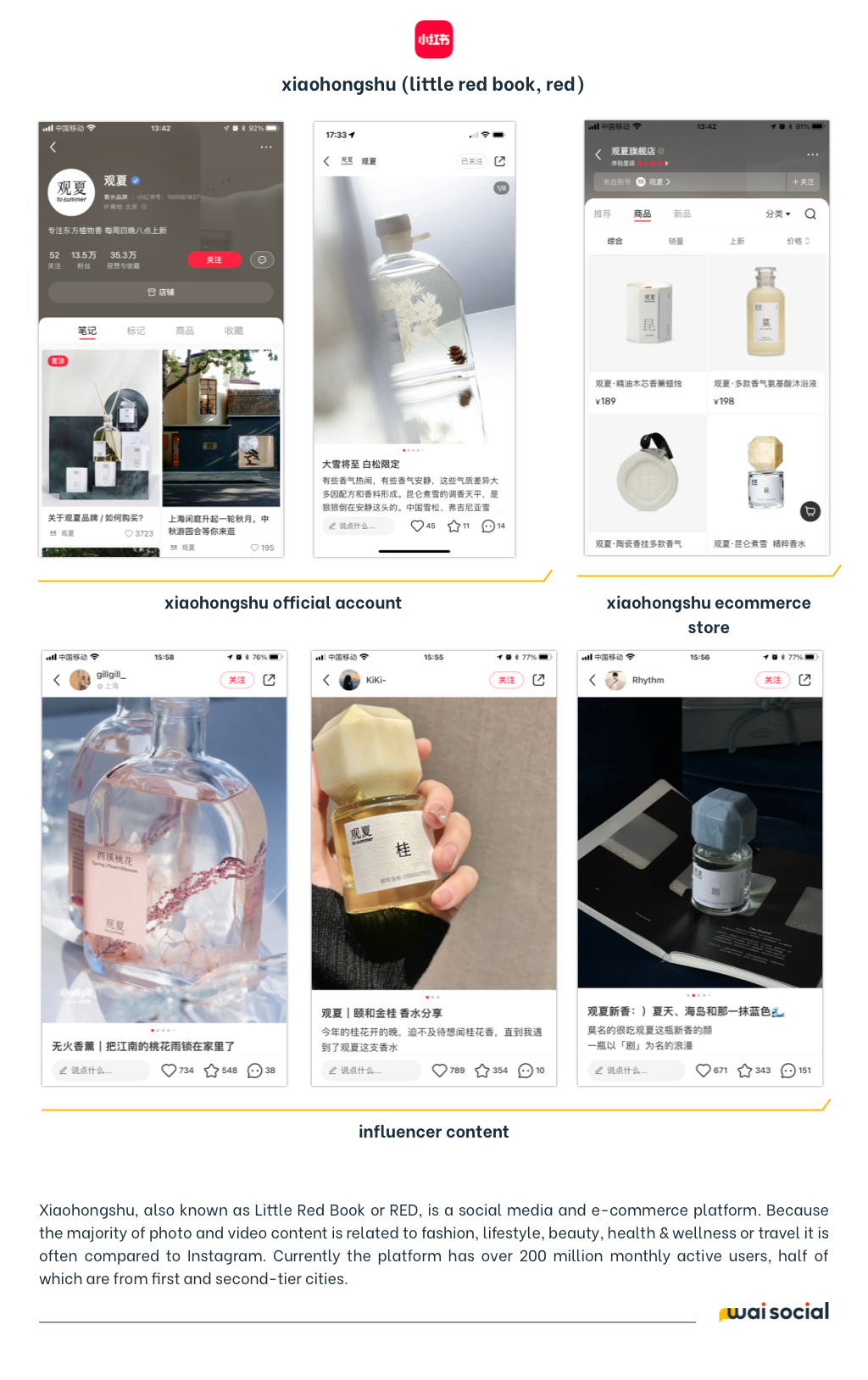

5. Quality, on-brand social content. To Summer’s content output on social media also adheres to the visual concept of Eastern aesthetics. Not only does the WeChat article layout look like a magazine, but even the content published by influencers on Xiaohongshu’s is very similar to the brand’s tone, often based on the user’s perception and philosophy, starting from personal experience, eliminating a ‘pushy sales’ feel and resonating well with consumers.

6. Create scarcity. In addition to working hard on visual design, To Summer also enhances the brand's sense of luxury by "scarcity marketing”. The more famous a single product is, the easier it is to sell out. The phenomenon of short supply is due to the laborious process of hand-making the products (quality and scarcity — a double win!).

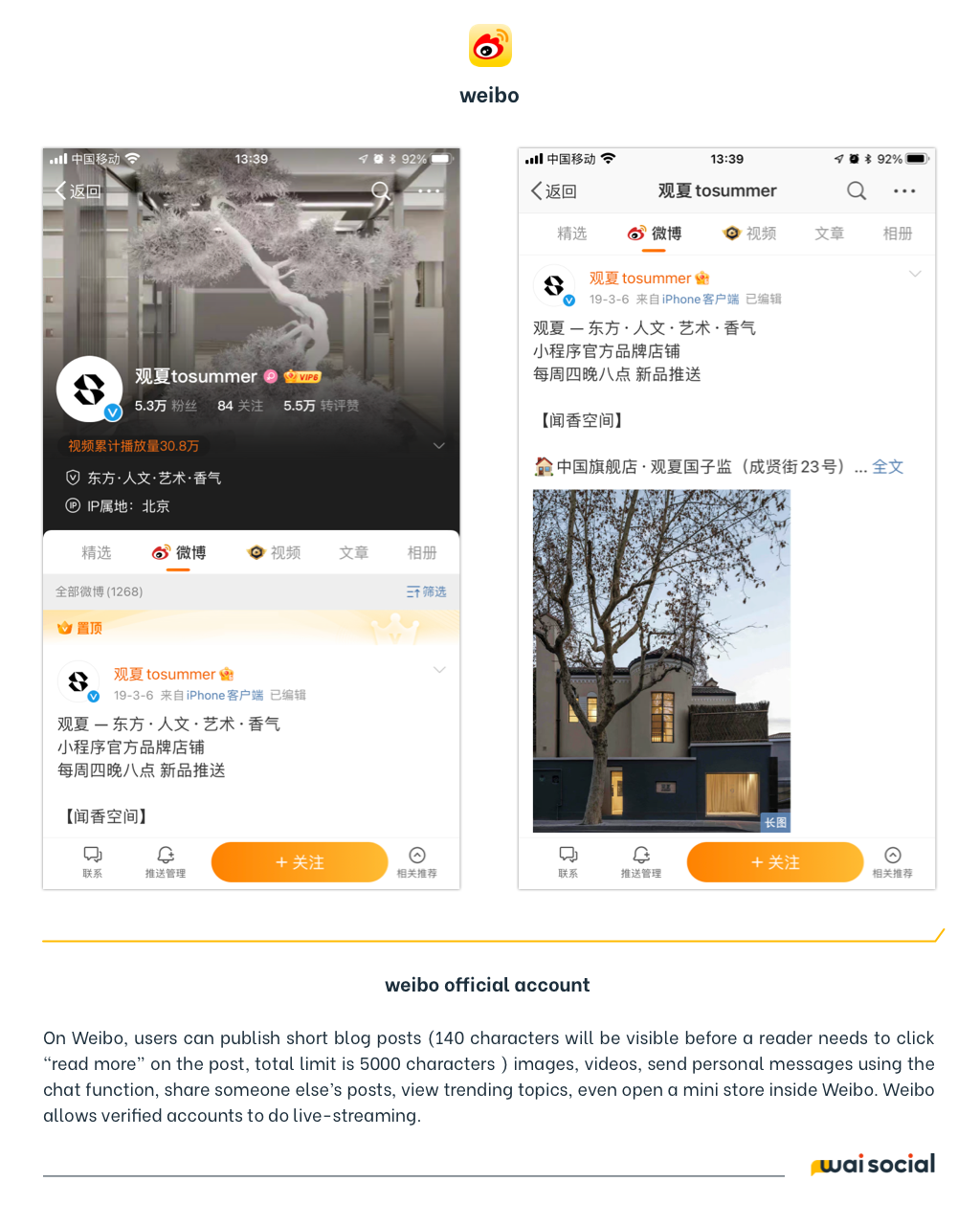

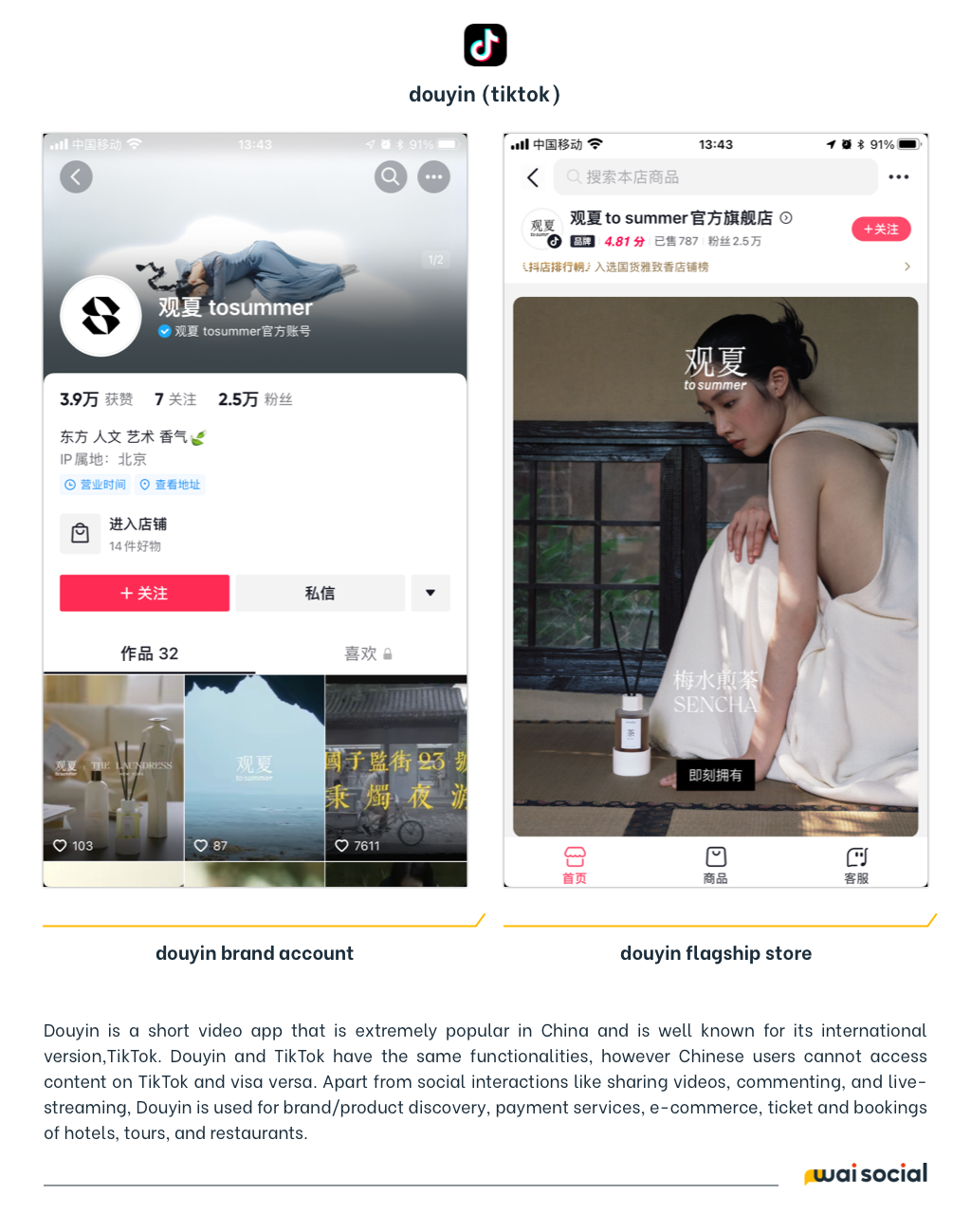

CHANNELS

Weibo (53k followers), WeChat with Channels & Mini Program Ecommerce Shop, RED with Ecommerce Shop (135k followers), Douyin with Ecommerce Shop (25k followers), Bilibili (2.2k followers)