Guide to Success in China: Sportswear Brand

This is a series from our weekly newsletter in which we send out original content covering trends, social campaigns and advice on how to grow your brand in China. This series, GUIDE TO SUCCESS covers the audience, channels, and strategy for an imaginary brand entering the China market. We hope this gives you a starting point to better understand the type of information you'll need to know about your customer and how to use the right channels to reach them. Get this sent directly to your inbox instead of having to visit our website next time.

THE BRAND

Sportswear brand heavily influenced by the growing health and wellness trend

THE TARGET AUDIENCE

Men & women

Age 20-35

Living in Tier 2, Tier 3 cities in China

ANALYSIS

First-tier cities have been a hub for trendy sportswear brands for several years now — think Lululemon and Nike — however as these cities have been hardest hit by long-term lockdowns, more and more young consumers have started to reconsider living conditions. They are increasingly moving out of large cities and back to their hometowns in second-and third-tier cities, bringing with them an appetite for fashion, health and fitness. In addition, as income levels are still steadily rising in these areas, more and more consumers turn to a healthy lifestyle and more ‘fulfilling’ activities.

As a new brand entering China we suggest to consider opening the first offline store or establishing a warehousing supply chain in second*- and third-tier cities.

*including those cities on the list of “New First-Tier”, such as Chengdu, Chongqing, Hangzhou, Xi'an, Suzhou, Wuhan, Nanjing, Changsha, Ningbo, Foshan, etc.

CHANNELS

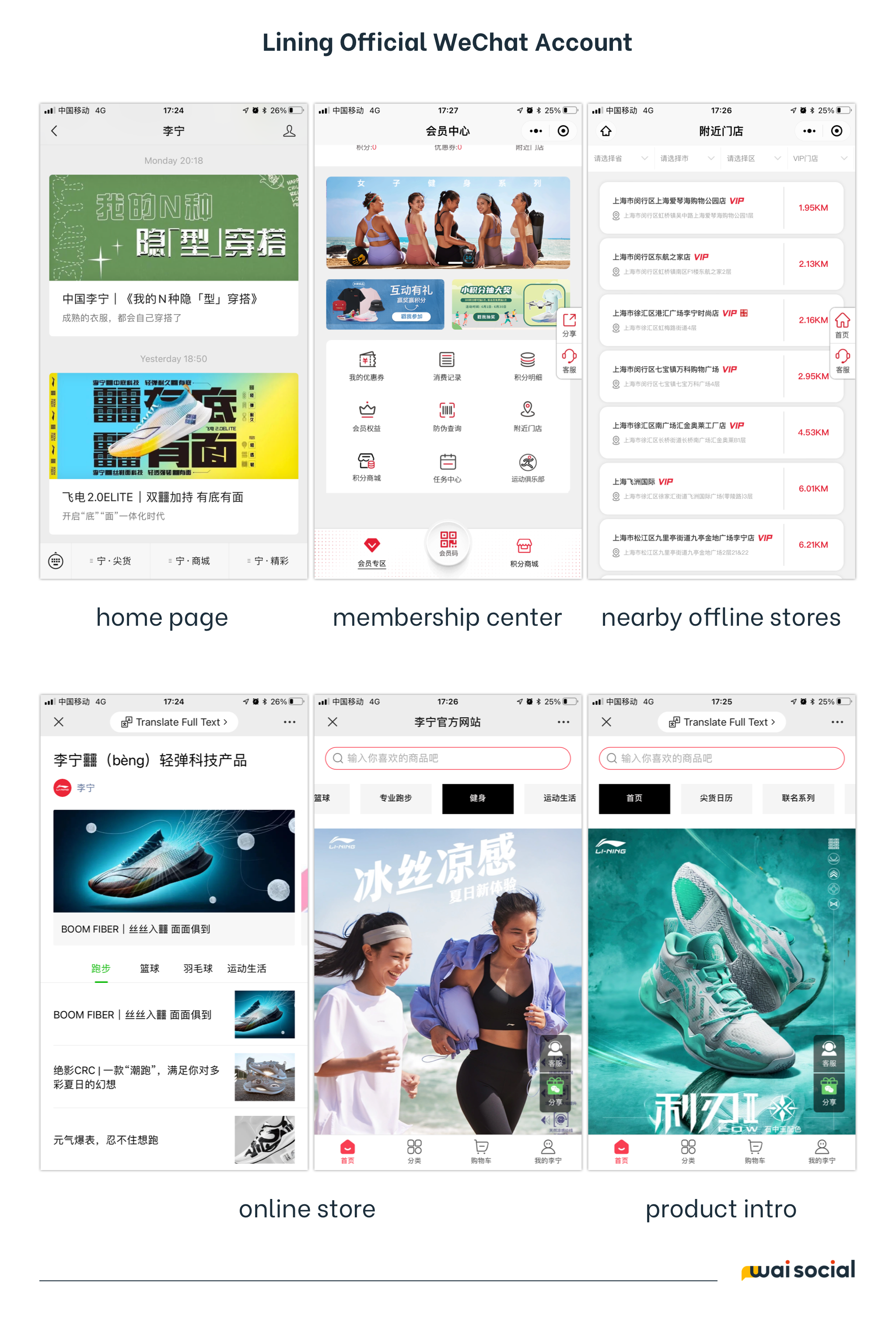

Leverage WeChat for the following:

Content creation — products introduction, brand news & events

Community building — brand membership registration & online sale through mini program before & after-sale service (store map, etc.)

Short Video

Open an account on Douyin and/or Kuaishou to target consumers who live in second-and third-tier cities

Be aware that traditional advertising videos are not an easy way to gain reach, also the execution and sustainability of content will be a challenge.

Live-streaming

Stream free home exercise courses with wellness tips. Consider creative collaborations with influencers or brand ambassadors during the live-stream. Don’t forget live-streaming is also an excellent way to make sales conversions as it is convenient for people to buy items directly through features of the live-streaming show.

Influencers

Residents living in second-and third-tier cities are easily influenced by celebrities, so if the budget is sufficient, you can first consider collaborating with well-known celebrities in the corresponding city or region as awareness-building. Through ambassador projects, product recommendations or offline event invitations, attract the attention of target groups and promote consumption.

Secondly, you can cooperate with popular influencers on short video platforms (Douyin, Kuaishou) to promote new products, and sell hero items in popular live-streaming rooms with value prices to expand awareness.

Audiences from the new first-tier cities are active on RED as well. It may not be essential to operate an official account on this platform but to seed influencers and KOCs (Key Opinion Customers, aka micro-influencers) on RED can expand the brand awareness — especially during the new product launches or promotion periods.

*Read more from us about influencer seeding on RED here

ECOMMERCE

Taobao or Tmall will be preferred, if this is not possible, consider a WeChat mini program as a second choice. Also, make sure to register online a store inside Douyin or Kuaishou to provide convenient access to purchase for consumers watching the live-stream shows.

OTHER IMPORTANT THINGS TO KEEP IN MIND

1. Since the consumption power of second-and third-tier cities is lower than that of first-tier cities, brands such as Lululemon or MAIA ACTIVE should not be taken as a reference in product pricing. Instead look to domestic local brands such as Li Ning, Anta, and Xtep. It is okay to have high-end series but the price range has to be wide enough to attract more potential consumers.

2. Since the further prosperity of the second-and third-tier markets is closely related to China's current pandemic prevention policies, product development and marketing communication points should focus on clothes and accessories suitable for indoor exercise, such as yoga, fitness dance, aerobics, dumbbells, spinning bike, running on treadmill, etc.

3. Young people who have studied or worked in first-tier cities but ultimately choose to settle in second-and third-tier cities will be the main target consumers. Different from residents who have lived in second-and third-tier cities for a long time, these consumers already have certain brand recognition and identification capabilities but are not satisfied with the limited choice of domestic brands. They yearn for a diversified quality of life. Develop precise brand positioning by understanding their consumption psychology.