China marketing latest trends for 2023

This is a series from our weekly newsletter in which we cover consumers, marketing, platform, economic and tech trends that brands in China need to know. Get the latest TRENDS newsletter edition sent directly to your inbox instead of having to visit our website next time.

Five trends to know for 2023:

📱 Digital transformation of sales model

👵🏼 The contribution & impact of China’s silver-haired generation to ecommerce platforms will be more prominent

✨ A quality-focused brand should trigger consumers to automatically share

🤖 More brands will be interested in Metaverse, especially digital collections

🤑 Changes in consumption structure, not reduction in consumption amount

📱 Digital transformation of sales model

Whether we like it or not, the shift to online and digital selling is in full force. In 2023, a large part of sales performance will still occur online, whether it is in the low-end retail or luxury category. What matters is how quickly companies adapt to it. Just because your sales force is no longer face-to-face with your customers doesn't mean the culture of that interaction has to suffer. As a business, rethink new ways of interacting with customers to provide a better overall experience.

Consumers love simplicity and immediacy. Text, chatbots, and social media all allow consumers to interact with your business in a casual yet effective way that won't blow your budget. For brands targeting middle-class and high-net-worth individuals, one-on-one online services will be more popular (this can be achieved by adding corporate WeChat, WeCom, or opening VIP customer service solutions on ecommerce websites) but remember to avoid over-pushing when it comes to marketing information, focus on thoughtful and timely responses.

Crash course on WeChat's enterprise solution WeCom

👵🏼 The contribution & impact of China’s silver-haired generation to ecommerce platforms will be more prominent

Due to the pandemic, the older generation who previously did not rely on online shopping have shifted to this purchase method as it became necessary to survive during unpredictable lockdowns and now as a wave of infections sweeps the nation.

This trend will further promote ecommerce sales of online supermarkets (especially fresh products) and other daily necessities, medicine and health care products.

Their shopping preferences, such as cost-effective products and domestic brands, will further impact the structure of the consumer market. In addition, various emerging brands and product lines targeting the elderly will also continue to emerge.

✨ A quality-focused brand should trigger consumers to automatically share

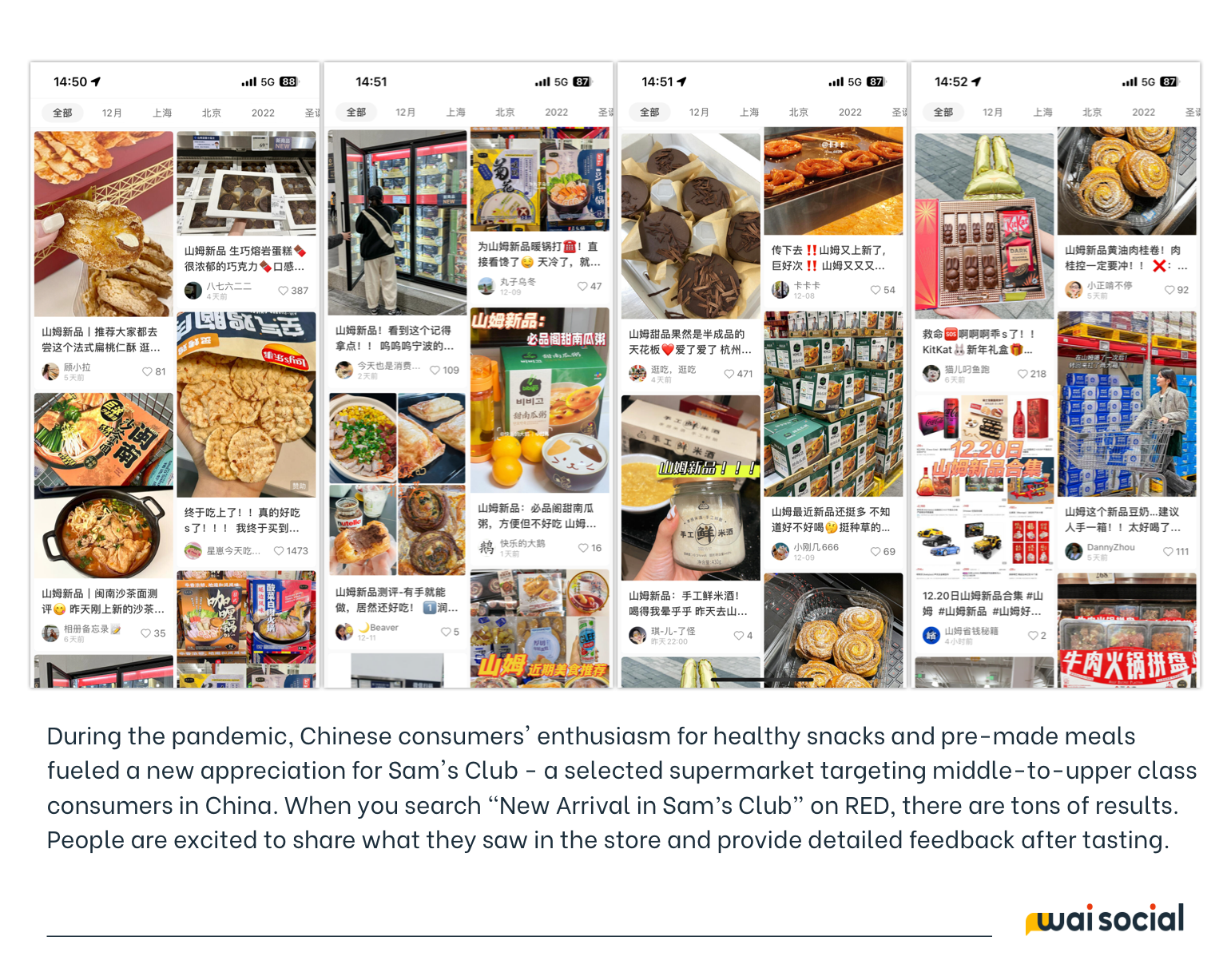

As we all know, launching UGC activities with prizes and extensive KOC (micro-influencer) collaborations are methods commonly used by many brands on social media in the past. The purpose is to encourage consumers to post product-related content from their personal accounts, thereby expanding the brand's popularity across digital channels.

This approach will remain mainstream in marketing in 2023, but it’s worth noting that social media posting by ordinary users is becoming more and more spontaneous. They are willing to take the initiative to share the good brands and products they have discovered without any commercial motivation behind it, and even use this as a theme of their personal accounts (for example, there are a large number of new Sam’s Club product discoverers on RED).

The creative distinction between personal and professional accounts is blurring. With the maturity and popularity of this behavior pattern, in a sense, it will become an indicator for us to judge the success of a brand in the future. Ultimately, it will allow brands to focus more on product development and store management, rather than consistently spending more of their marketing budget “in exchange” for consumer content creation.

🤖 More brands will be interested in the Metaverse, especially digital collections

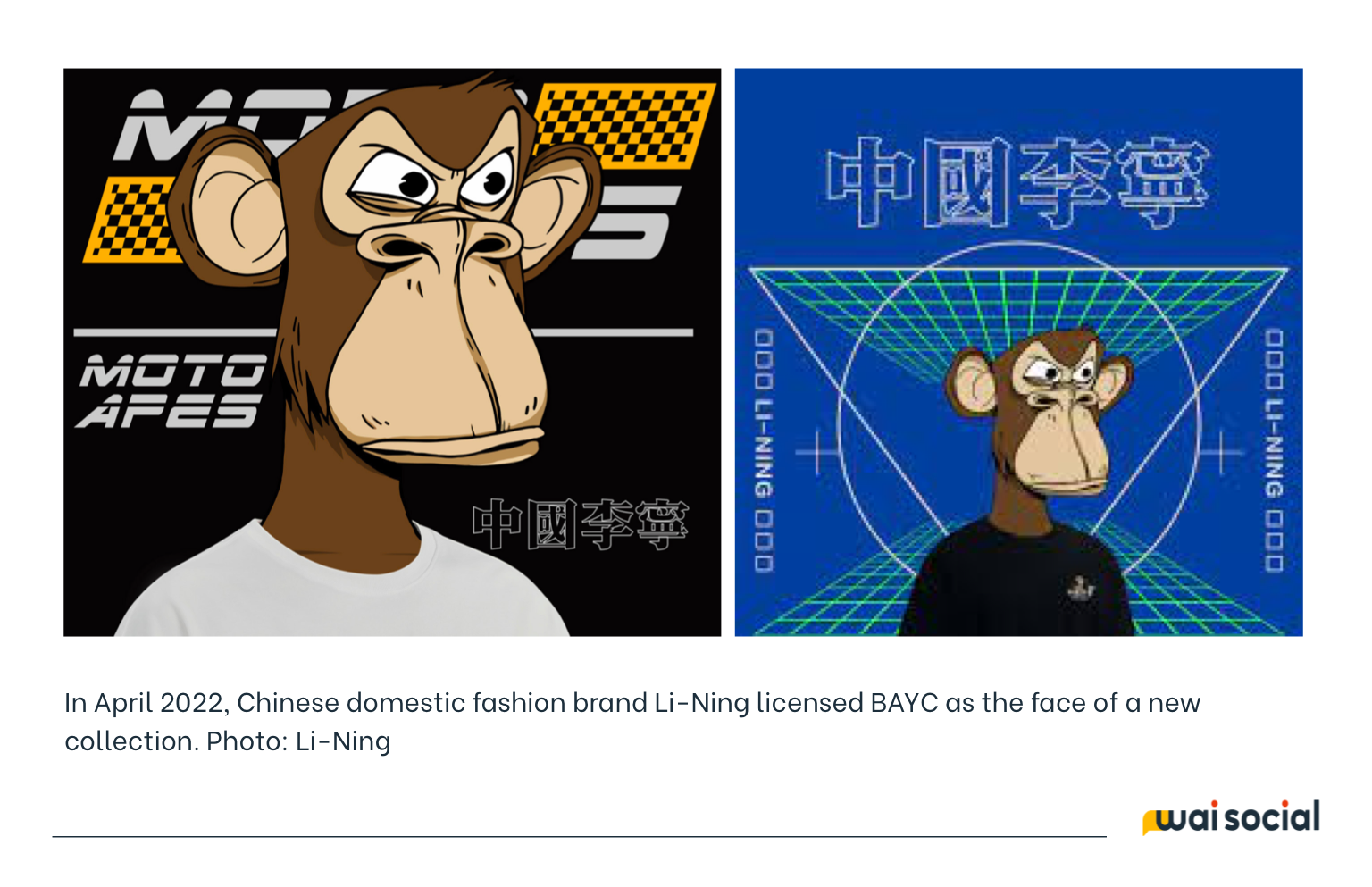

In recent years, the continuous maturity of virtual reality and other technologies has made the Metaverse a new opportunity for brands to try. As pioneers and explorers in marketing, fashion brands have been actively exploring this new field, such as Gucci, LV, Tiffany, etc.

In 2022, the normalized home office model and the increasing difficulty of private domain traffic will force marketers to look for new growth opportunities. In 2023, this trend will continue. More companies will hope to use emerging technologies and means to have more interactions with young consumers.

According to market observations, in addition to virtual digital celebrities, NFTs are one of the most important strategies for companies to deploy in the Metaverse. Benefits such as relatively low marketing cost and scarcity model make it an attractive tool for accumulating VIP customers. The development pace of NFT has expanded from the initial art field to the brand side. Brands tend to enrich their digital assets by cooperating with artists, creating digital derivative peripherals, livestream + mystery boxes (盲盒) + digital collection and other methods.

🤑 Changes in consumption structure, not reduction in consumption amountMore brands will be interested in the Metaverse, especially digital collections

MGI data show that the number of urban households earning incomes of more than RMB 160,000 ($21,800) expanded at a compound annual growth rate (CAGR) of 18 percent between 2019 and 2021, rising from 99 million to 138 million. By 2025, another 71 million households could enter this high-income bracket, underscoring the vibrant potential of China’s consumer market.*

*Source: 2023 McKinsey China Consumer Report

High-income consumers are spending more, rather than less. Unless there is a deliberate reduction in spending, China's middle class will continue to maintain the same slightly higher daily consumption in 2023.

However, the consumption structure will inevitably undergo the following changes:

1. Rising consumption of medicines and health care products

2. Rising consumption of home fitness equipment

3. Rising consumption of home beauty equipment

4. Rising consumption of home entertainment equipment

5. Rising consumption of pre-made meal (easy to cook at home dishes) and sugar-free, high-protein, organic foods

6. Rising consumption of wine & drinks

7. Reduced dining expenses in restaurants

8. Decreasing consumption in offline entertainment venues, such as KTV, bars, cinemas, etc.

9. The frequency of purchasing products through e-commerce channels keeps increasing, while bulk buy behavior is not limited to certain shopping festivals

10. Value-preserving luxury goods and noble metal products will attract more consumption intentions

11. In general, consumers' consumption choices of similar products will trend towards more premium brands

It should be noted that the market trend in 2023 will be affected by the development of the pandemic situation in mainland China. If the effectiveness of local vaccines really cannot reach the international standard, the number of deaths in old generation will rise steadily which means many families stand to lose parents & grandparents tragically. In addition the ecommerce economy may also suffer from insufficient manpower, and increases in commodity prices.